get in touch

Headquarters

Suite 12 Level 1 16 Main Street

Blacktown NSW 2148

Email Us

info@experttax.com.au

Call Us

02 8631 4118

Suite 12 Level 1 16 Main Street

Blacktown NSW 2148

info@experttax.com.au

02 8631 4118

Individual Tax Returns

At Expert Tax Accountants we can complete your return either face to face or online. We complete a comprehensive list of questions, ensuring you do not miss out on any allowable deductions and tax offsets. We will maximise your tax refund as much as legislation will allow and look at all the avenues of possible tax deductions, tax credits, tax exemptions and tax offsets.

Save time - Do it online

Just email us on info@experttax.com.au with your name and number and one of our fully qualified accountants will get back to you within 2 hours (during business hours) to discuss and gain information to prepare your tax return. Once your return is prepared you can authorise the lodgement via e-sign on your computer or smartphone. It's as simple as that.

At Expert Tax Accountants we help you with simple to complex company tax returns.

Whether you are a:

We will look after your business tax and accounting needs that can affect your business financial situation. Our expert Accountants offer a range of tax and accounting solutions; tailored to fit your business.

Tax returns and Business activity statements are a mandatory reporting requirement for all types of businesses and structures. We’ll collate your bank statements, invoices, receipts, MYOB/XERO/QUICKBOOKS backups and reports and, once your statements have been finalized and approved by you, we’ll lodge them with the ATO on your behalf. No matter how complicated your situation is, we’ll make sure your returns are completed correctly. We’ll ask all the right questions to uncover and record every deduction and relevant detail so that you achieve the highest return.

At Expert Tax Accountants we emphasise on the importance of the financial statements to our clients.

We help businesses not only prepare but also understand their Financial statements, which in turn helps them understand their business in more depth.

We, accurately and diligently prepare your main 4 Financial statements:

(1) balance sheets

(2) income statements

(3) cash flow statements

(4) statements of shareholders' equity.

We like to keep it in-house. Expert Tax Accountants payroll teams are strongly focused on working with local clients from our Blacktown office. We do not pass on your work overseas. Our payroll solutions are completely flexible and scalable, allowing you to choose the level of service that is most appropriate to your needs, both now and in the future.

Our teams will undertake payroll administration and processing activities, increasing efficiency and productivity by enabling your own staff to focus on the business’ core functions.

We advise our clients of all the statutory requirements with respect to the employees that must be met and take on the day-to-day management of these to ensure that you remain compliant at all times, mitigating the risk to you. We can draw upon specialist knowledge and advice to assist with any issues requiring more complex employment advice.

What we do:

Cash flow projection is a breakdown of the money that is expected to come in and out of your business. This includes calculating your income and all of your expenses, which will give your business a clear idea on how much cash you'll be left with over a specific period of time.

Understanding and predicting the flow of money in and out of your business, however, can help entrepreneurs make smarter decisions, plan, and ultimately avoid an unnecessary cash flow crisis.

If, for example, your cash flow projection suggests you’re going to have higher-than-normal costs and lower-than-normal earnings, it might not be the best time to buy that new piece of equipment. If, on the other hand, your cash flow projection suggests a surplus, it might be the right time to invest in the business.

Where are the projections used:

Starter Business Plan – Just $495 + GST

The Starter Business Plan is perfect for when you need a professionally-written and presented overview of your business opportunity.

You get a 10-12 page document that explains clearly all the important aspects of your business, when you are applying for a bank loan, low to mid-level private investment, a franchise application, or any other VIP.

Usages of a business plan:

For every capital gains tax (CGT) event that happens to your assets during the year, we help you work out your capital gain or loss and eventually work out your net capital gain or net capital loss for the year.

Individuals and small businesses (excluding companies) can generally discount a capital gain by 50% if they hold the asset for more than one year.

We also help in:

Your Business Is Our Focus

We offer efficient, reliable and professional bookkeeping service so that you can concentrate on developing your business instead of worrying about your accounts.

Our services include:

How simple the process is?

We can take over your books and create a highly efficient bookkeeping system to provide you with your most accurate accounts.

It can be on a weekly, fortnightly, monthly or annual basis with cloud accounting, so you can check in online from wherever you are based.

Online Accounting

Log in from anywhere - that’s the beauty of cloud-based accounting.

The information is encrypted, much like a bank’s, so only people with the login can view the data. Most systems like XERO, MYOB, QuickBooks come with tools for quoting, invoicing, managing bills and more.

We help you set-up your business accounting online and manages it for you.

From then on, you can access your accounts from any web browser, or from an app on your phone. We will connect the software to their business bank account, so that banking transactions flow automatically from the bank to the books. This saves them from a lot of data entry.

Running your business accounts online has many advantages:

Data about your sales or income and purchases can flow straight from your bank to your books so you don’t spend hours transcribing them.

You can see your current financial position at any time.

Multi-user access makes it easy to collaborate online with your team and advisors.

It’s online software so there’s nothing to install or update, and all your data is backed up automatically.

You can set up a dashboard showing important financial information like who owes you money, what bills are due, and how your cash flow is looking.

At Expert Tax Accountants, we focus on providing clients with specialized taxation solutions and recommending effective business strategies. Our expert team is skilled in a range of industries in small to medium businesses, company trusts and partnerships.

In life, business and personal circumstances change continuously, and taxation requirements also change. We regularly review our clients tax needs to align with ongoing changes, ensuring that you meet your compliance obligations and benefit from tax planning opportunities.

Starting a business and choosing the appropriate structure should not be considered lightly. There are four main structures for running a business, each with its advantages and disadvantages.

Before you consider a company formation, you may want to analyse the four different business structures.

If a company formation is the direction you want to head in, you’ve come to the right place.

Starting a Business involves a wide range of dealings with government agencies and can seem quite daunting if you’re unfamiliar with the process.

Our Company Formation services include:

Expert Tax Accountants is a registered ASIC agent that is authorised to lodge company related documents with ASIC on behalf of a third party. We act as an intermediary and usually help a company meet their lodgement obligations under the Corporations Act 2001. We can lodge the paper forms with ASIC or make use of ASIC's electronic lodgement system EDGE. By using EDGE we can lodge company registration applications 24/7 and have the ACN and certificate in minutes.

Our ASIC services:

First Home Buyer:

Refinance:

Investment Property:

Self Employed:

Car Loan:

Truck Loan

Small Business Loans:

Equipment Finance:

Commercial property:

Having a solid financial foundation is important to the growth of your business. Expert Tax Accountants can negotiate the right structure, facility, conditions and rates for your loan with our extensive panel of lenders. We place special emphasis on our business deals and aim to deliver you the best rates and outcome possible.

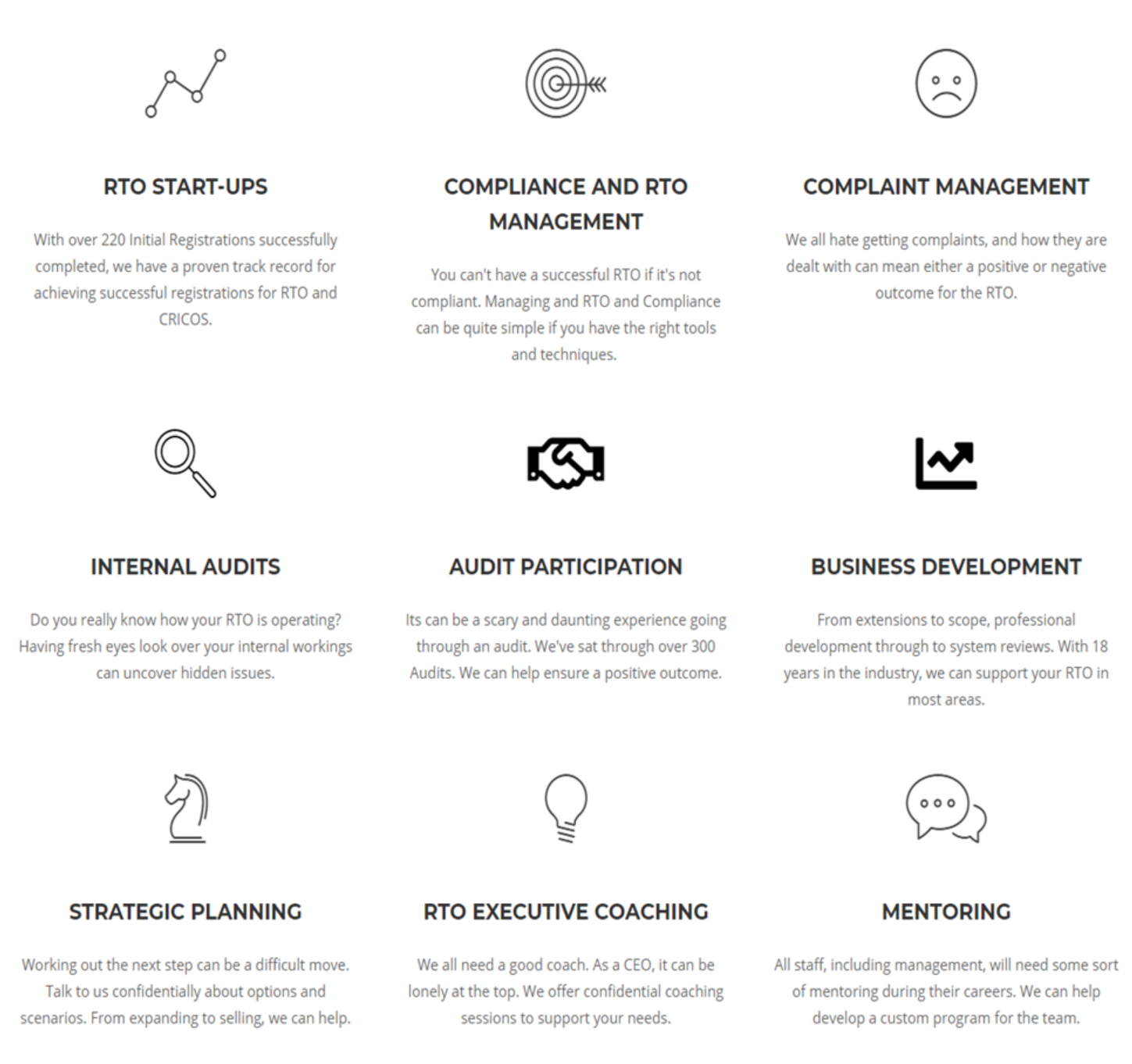

The Financial Viability Risk Assessment Requirements aims to ensure that an applicant RTO is financially sound and has the resources to operate as an ongoing concern, delivering quality training and assessment services throughout the registered period.

The financial information is required when an organisation wants to lodge an initial RTO registration with ASQA or as ASQA deems necessary (for example, prior to ASQA agreeing to renew an RTO’s registration or following a formal complaint).

you will need to engage a qualified Accountant (Chartered Accountant (CA) or Certified Practising Accountant (CPA)) to ensure the financial data and the business plan meet the ASQA financial viability requirements.

You need to ensure that you are aware of the standards and regulations governing financial viability in the VET sector. You also need to ensure that you provide all the details required in the Financial Viability Risk Assessment Pack.

Our experienced consultants help in ensuring you provide the appropriate financial data and prepare your financial viability form quickly and efficiently.

What we will provide/do for you:

We will support you throughout your financial viability risk assessment application process to ensure it is completed quickly and efficiently, while maintaining compliance with ASQA’s Standards for RTOs.

Our experienced consultants will do most of the work for you, from start to finish. We will manage the application process, so you can focus on managing your RTO and delivering quality training services to your students.

Our team of qualified and RTO experienced accountants specialise in the preparation of the ASQA Financial Viability Risk Assessment Tool.

The FVRA Tool is a complex excel spreadsheet that can be overwhelming for RTO’s and their accountants to complete. The importance of the FVRA Tool means you shouldn’t leave its preparation to chance. Your RTO Accounting Specialists’ team successfully prepared FVRAs for RTOs across Australia.

Using our unique online information form we gather all the information needed to prepare the FVRA Tool. Our team maintains unlimited open communications with our clients ensuring that their business is reflected accurately and completely, resulting in a financial liability risk assessment tool that demonstrates accurately the viability of their business.